Taking a look at the appeal of private equity as a popular business division.

Private equity is regarded to be among the most reputable and competitive career courses in the finance industry. It is known for integrating both financial knowledge and business management into an interesting and challenging location of industry. Professionals in this sector will be involved in a range of activities, including closely studying companies, identifying areas for development and helping leadership make more strategic decisions. This industry is known to be fulfilling in the long run as there are many areas for growth and opportunities to discover. Compared to other economic divisions, such as investment banking. which mostly includes giving financial suggestions during mergers or acquisitions, private equity provides a more active and longitudinal role in shaping the future of a business. For individuals who find complete satisfaction in solving complex problems and strategic thinking, private equity as a career provides a purposeful and intellectually difficult sector for employment.

Private equity as a job is known for offering strong financial benefits and outstanding career advancement opportunities. Entry level roles in private equity are known for providing high wages from the start of your career along with large bonuses. Furthermore, as professionals gain here more experience their revenues can increase substantially. Aside from satisfying salary growth, the experience acquired in private equity sector specialisation is incredibly valuable and widely respected across many areas of business. These types of roles will help to build abilities in financial strategy negotiation and in many cases management which are extremely transferable in several other sectors. William Jackson of Bridgepoint Capital would likely agree that due to its strong track record and wide-reaching career choices, private equity is an outstanding career choice. Likewise, Travis Hain of Ridgemont Equity Partners would recognise the appeal of private equity for people who have an interest in the finance and business segments.

Among the main reasons private equity attracts numerous young professionals is its long-term focus. Rather than making short-term investments private equity firms will generally hold these investments for a duration of 3 to seven years. Throughout this period, they fulfil a variety of jobs and work carefully with the business executives to enhance profits, cut down unnecessary expenses and widen into new markets. Howard Marks of Oaktree Capital would understand that this type of work requires a good deal of patience and industry knowledge to develop purposeful transformation. In time, professionals in private equity will be able to clearly see the effect of their efforts over the past couple of years. Through helping a company grow or preparing it for a successful selling process, playing a key part in the long-term strategy for business growth makes the private equity career path various from many other finance careers.

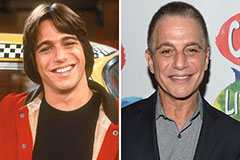

Tony Danza Then & Now!

Tony Danza Then & Now! Barret Oliver Then & Now!

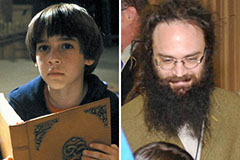

Barret Oliver Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!